New York workers’ compensation insurance

Every employer in New York must provide workers' compensation insurance for their employees. This policy covers the cost of medical care for workers who are injured on the job.

Who needs workers’ comp insurance in New York?

The state of New York requires all employers to carry workers’ compensation insurance for their employees.

According to state law, there are very limited instances when an employer would be exempt from this requirement. The only situations in which an employer would not be required to provide coverage are:

- If the business is owned by one individual and there are no employees, leased employees, borrowed employees, part-time employees, unpaid volunteers, or subcontractors.

- If the business is a partnership or corporation and has no employees (based on the above specifications).

- If the business is owned by one or two people, and those people own all stock and offices, and there are no additional employees.

The law also requires employers to conspicuously post a notice that indicates their workers’ compensation insurance coverage. Notices must include the name, address, and phone number of the insurer and the employer’s policy number.

Do you need workers’ compensation if you are self-employed?

If you are self-employed or the sole proprietor of a business, you're not required to buy workers' compensation for yourself.

However, it's still a good idea to purchase this coverage. If you suffer an on-the-job injury and you don't have workers' comp, you could end up paying for expensive medical bills out of pocket, as personal health insurance might not cover work injuries.

Workers' comp also pays for part of the wages you lose while unable to work, which could save your business if you're sidelined for a long time with an injury.

Is workers’ comp mandatory in New York for part-time employees?

Most people who are paid to do a job are considered employees and would be required to be covered by workers’ comp. New York law classifies day labor, leased or borrowed employees, part-time employees, unpaid volunteers (which includes family members), and most subcontractors as employees for the purposes of workers’ compensation.

The exception would be an independent contractor, who must fall under each of these criteria:

- The contractor is not under the employer’s control or direction while performing a job.

- The contractor is performing services that the company does not do in its regular course of business.

- The contractor has an independently established trade, occupation, or business that is related to the service being performed.

The state of New York requires all employers to carry workers’ compensation insurance for their employees.

What does workers' comp cover for New York businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- A barista suffers burns on their hands while preparing a hot beverage for a customer. Workers' comp covers their doctor's appointment and pain medication, as well as provides disability benefits to replace part of the wages they miss while they're recovering.

- A roofer develops a back injury from several years of bending over on a roof installing shingles and can no longer perform their job duties. In this instance, workers' compensation would also provide retraining benefits so they could learn skills to take on a new job.

- A consultant trips on a staircase at their office and breaks their leg. Workers' comp covers the cost of the ambulance ride, emergency room visit, surgery, medications, and then two months of physical therapy to help them recover.

- A cleaning company employee suffers from respiratory ailments after years of using harsh cleaning chemicals. After filing a workers' comp claim, they receive permanent disability payments for their ongoing lung issues.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers’ compensation insurance cost in New York?

The average cost of workers’ compensation in New York is $38 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as New York City (NYC), Buffalo, or a more rural area

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

How do you buy workers' compensation in New York?

There are three ways for New York employers to purchase a workers' compensation insurance policy:

- You can buy a policy from a private insurance company. You could contact each insurer independently to compare their products and rates, but that's where agents and brokers like Insureon come in. As the nation's leading digital insurance agency, Insureon partners with 30+ top-rated insurance carriers to deliver the right coverage for your business. Fill out an easy online application to get started.

- You can buy a policy from the state fund. The New York State Insurance Fund is a competitive state fund that competes with private carriers and guarantees coverage, even for businesses declined elsewhere.

- You can apply for self-insurance. Your business must meet certain criteria to qualify for self-insurance. For example, you must have a workplace safety program.

Verified workers' compensation insurance reviews

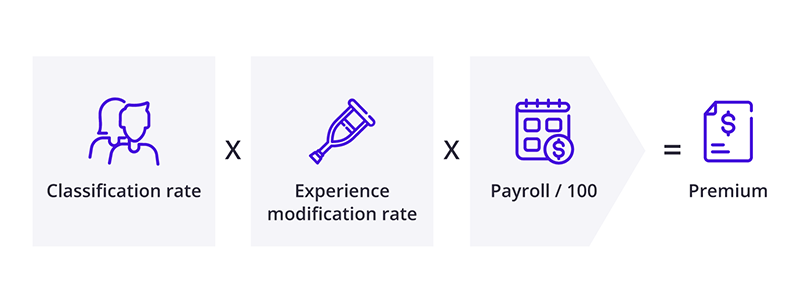

Insurance providers use a specific formula for calculating workers' comp premiums:

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, tree trimmers, and others with a higher rate of injuries. New York uses the New York Compensation Insurance Rating Bureau (NYCIRB) database, unlike other states that rely on the National Council on Compensation Insurance (NCCI).

- The experience modification rate (EMR) reflects your business's risk. The average EMR is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to come up with your workers' comp premium.

Because your business will likely change over time and look different from what you originally estimated when you purchased workers’ compensation insurance, your insurer will perform an insurance audit annually to adjust your policy and premium accordingly.

How can New York business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure. This also helps you avoid misclassification fines.

In some cases, small business owners can choose to buy pay-as-you-go workers' compensation. This type of workers' comp policy has a low upfront premium, and lets you make payments based on your actual payroll instead of estimated payroll. It's useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, though not permitted in New York. A ghost policy is a workers' comp policy in name only. It provides no protection, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers' comp work in New York?

Workers' compensation covers the cost of medical bills for employees who suffer a workplace injury or develop an occupational disease. It also provides disability benefits while employees are unable to work, typically two-thirds of their average weekly wage.

Most workers' compensation policies include employer's liability insurance, which helps cover legal defense costs if an employee blames their employer for an injury. However, the exclusive remedy provision in most workers' comp policies prohibits an employee from suing their employer once they accept workers' comp benefits.

Workers' compensation benefits for injured employees in New York include:

- Medical benefits covering all medical expenses related to the injury

- Lost wage benefits for employees who are out of work for more than seven days

- Cash benefits for employees who suffer a loss of function or other permanent disability

- Related expenses, such as mileage reimbursement for travel to a doctor's office

- Death benefits for fatal incidents

It is an employee’s responsibility to inform the employer or supervisor when an injury or accident has occurred. The injured worker must seek treatment only from a healthcare provider that is authorized by the NY Workers’ Compensation Board (WCB), unless treatment is provided in an emergency situation.

Generally, an employer cannot direct employees to specific medical providers, unless the employer participates in a Preferred Provider Program or Alternative Dispute Resolution Program. The employer could recommend a provider, but the employee must also be informed of their right to select a provider of choice.

When the employer becomes aware of an injury that might be covered by workers’ compensation insurance, the employer should communicate with its insurance provider throughout the workers’ compensation claim process.

A minor injury that requires two or fewer first aid treatments and that causes the employee to return to work in one day or less could be compensated directly by the employer. Any other injury must be reported to the Board and the workers’ compensation insurance carrier within 10 days.

What are the penalties for not having workers’ compensation in New York?

The New York State Workers’ Compensation Board regulates and enforces all workers’ compensation requirements in the state. New York requirements that are not followed can result in serious civil and criminal penalties.

Failure to secure coverage for five or fewer employees within a one-year period is a misdemeanor and is punishable by a fine of between $1,000 and $5,000. If the failure to secure coverage is for more than five employees, it becomes a felony punishable by a fine of between $5,000 and $50,000. If there is a subsequent conviction within five years for failure to secure coverage, the fine would be between $10,000 and $50,000 and could include other penalties and fines.

Failure to make a provision for payment of compensation for 10 days or more would leave the employer open to civil action by the board. The board could impose a penalty of up to $2,000 for each 10-day period of noncompliance or a sum up to twice the cost of compensation during that period.

Misrepresentation by an employer of the number of employees, classification, wages, and accidents is subject to criminal and civil prosecution. A business is required to maintain accurate records. If the employer intentionally understates or conceals payroll, conceals employee duties to avoid classification, or conceals other information, it could result in a fine of $2,000 for every 10-day period of noncompliance or twice the cost of compensation. If an employer is criminally convicted based on these charges, the fine would be $1,000 to $50,000.

Failure to maintain accurate payroll is also a criminal offense. If an employer does not keep accurate records about employee classifications, information about accidents, and wages, it can be found guilty of a misdemeanor and subject to a fine of between $5,000 and $10,000. If the employer has been convicted on this basis in the past, the conviction becomes a felony, and the fine would rise to $10,000 to $25,000. The civil penalty for these offenses is $1,000 per 10-day period of noncompliance or twice the cost of compensation for the employer’s payroll during the periods of time when the failure occurred.

New York workers’ compensation law for death benefits

When a person dies as a result of a work-related injury or illness, their dependents are entitled to receive workers’ compensation death benefits.

New York classifies a spouse and minor children as primary dependents. The surviving spouse would usually receive benefits for the remainder of their life, unless they remarry. If the spouse remarries, a lump sum equal to two years of benefits would be delivered. If there are no children, the spouse receives 66.67% of the deceased worker’s average weekly wage up to the statutory maximum.

If there are surviving children, the rate remains the same but the benefits are divided so that 36.6% of the weekly rate is given to the spouse, and the children equally split the remaining 30%. Children’s benefits end when they reach 18 years old, or 23 years old if they are full-time students. If there is not a surviving spouse or children, benefits could be awarded to the deceased worker’s parents or estate.

As part of workers’ compensation death benefits, New York also provides assistance for funeral expenses. However, the amount of funeral expense benefits in New York vary depending on where the deceased was a paid worker. For example, in the counties of the Bronx, Kings, Nassau, New York, Queens, Richmond, Rockland, and Westchester, New York assists with funeral expenses up to $12,500.

Workers’ comp settlements in New York

There are two ways for insurance companies and injured workers to reach workers’ compensation settlements in New York.

A stipulation agreement is when the injured worker and the insurance company can agree on the degree of disability and how much the worker will need in benefits. The benefits are disbursed to the employee on a set schedule. A stipulation agreement could be modified later if the worker’s condition worsens over time.

With a Section 32 settlement, both parties agree to close the claim in exchange for a lump sum payment. Once approved by the Board, the settlement is final, and the injured worker no longer has rights to modify the claim.

Workers’ compensation statute of limitations in New York

The workers’ compensation statute of limitations in New York is two years. That time begins either from the date of injury or the date that the claimant should have reasonably become aware of a work-related injury.

For example, if an employee falls and suffers a back injury while working on a structure in Manhattan, they might return to work immediately and not require medical treatment. However, if they experience back pain a few weeks later that is determined to be a result of the fall, they would have two years from that diagnosis to file a workers’ comp claim.

The statute of limitations for work-related hearing loss is slightly different. In that case, a worker cannot file a claim until 90 days after the loss occurs.

Get free quotes and buy online with Insureon

If you're ready to buy a workers' compensation policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy